March 4, 2025

Balancing Flexibility and Automation: How Concourse AI Reporting Agents Transform Financial Reporting

Discover how Concourse AI Reporting Agents are breaking the traditional trade-off between automation and flexibility, enabling finance teams to achieve both efficiency and adaptability in financial reporting without compromise.

The False Choice in Financial Reporting

For decades, finance leaders have faced a seemingly unavoidable trade-off: choose automation through rigid software solutions or maintain flexibility through manual, people-driven processes.

This dichotomy has forced teams to compromise, either sacrificing adaptability for efficiency or vice versa. And in most case, teams are investing in both scaling software tooling in addition to hiring team members in the US, overseas, and contractors to balance the business needs.

But what if you could have both?

Today, we're exploring how Concourse's AI Reporting Agents are fundamentally reshaping this landscape by delivering automation without sacrificing the flexibility finance teams desperately need.

The Promise of Automation in Finance

The Evolution of FP&A Software

The financial planning and analysis (FP&A) software market has grown exponentially over the past two decades. From the early days of on-premise solutions to today's cloud-based platforms, the market for global financial management software is expected to be valued at $24.4 billion by 2026 according to Gartner.

These solutions emerged as a direct response to the limitations of spreadsheet-based reporting: version control issues, manual errors, time-consuming data aggregation, and lack of scalability. The value proposition was compelling: centralize your financial data, automate routine calculations, and generate standardized reports at the click of a button.

The Implementation Reality

But the reality has rarely lived up to the promise. Implementation timelines for traditional FP&A platforms average 6-9 months, with some enterprise deployments stretching beyond 18 months. According to a 2023 survey by APQC, 72% of finance leaders report that their FP&A software implementations exceeded initial budget estimates.

The significant time and resource investment creates immediate pressure to demonstrate ROI, often leading to rushed implementations that fail to account for the nuanced reporting needs of different stakeholders.

The Flexibility Gap

Even after successful implementation, traditional FP&A platforms reveal their greatest weakness: inflexibility in the face of changing business needs. When executives request a new reporting view or when the business reorganizes its structure, finance teams find themselves back in spreadsheets, manually manipulating data exports from their "automated" systems.

This explains why, despite significant investments in automation tools, 80%+ of finance teams still rely heavily on spreadsheets for critical reporting functions. The promised land of full automation remains elusive because the software simply cannot adapt at the pace of business.

The Churn Problem

This gap between promise and reality has created a persistent churn problem in the FP&A software market. A 2023 study by Dresner Advisory Services found that 41% of organizations were considering switching their financial reporting solutions within the next two years, citing inflexibility and failure to meet evolving business needs as primary drivers.

The Reality of Flexibility The Human-Centered Alternative

Many finance leaders, burned by disappointing software implementations, have doubled down on flexibility by building larger teams and establishing manual processes. This approach offers immediate benefits: custom reports tailored exactly to stakeholder needs, the ability to pivot quickly when business priorities change, and no lengthy implementation cycles.

The Hidden Costs

However, this flexibility comes at a steep price. Finance teams operating with primarily manual processes spend up to 75% of their time on data collection, validation, and report generation rather than analysis and strategic insight, according to a 2022 study by McKinsey.

To manage these operational burdens while controlling costs, many organizations have turned to offshore resources. While this approach may reduce direct expenditure, it introduces new challenges: communication barriers, time zone complications, and knowledge transfer difficulties.

The Scaling Problem

Perhaps most critically, manual processes simply don't scale. As organizations grow more complex, the reporting burden grows exponentially. Finance teams find themselves perpetually playing catch-up, with 67% reporting that they're unable to complete all required reports on schedule during critical periods like month-end or quarter-end closings (PwC Finance Effectiveness Benchmark, 2023).

This creates a vicious cycle where finance professionals spend so much time producing reports that they have no time to leverage those reports for strategic insight—the very purpose for which they were created.

Concourse’s AI Reporting Agent

Combining Automation and Flexibility

Concourse AI Reporting Agents represent a fundamentally new approach that transcends the traditional automation-flexibility trade-off. Unlike conventional software that requires rigid configuration, AI agents can:

- Understand natural language requests to generate new report views instantly

- Adapt to changing organizational structures without requiring technical reconfiguration

- Pull from multiple data sources to create comprehensive views without manual integration

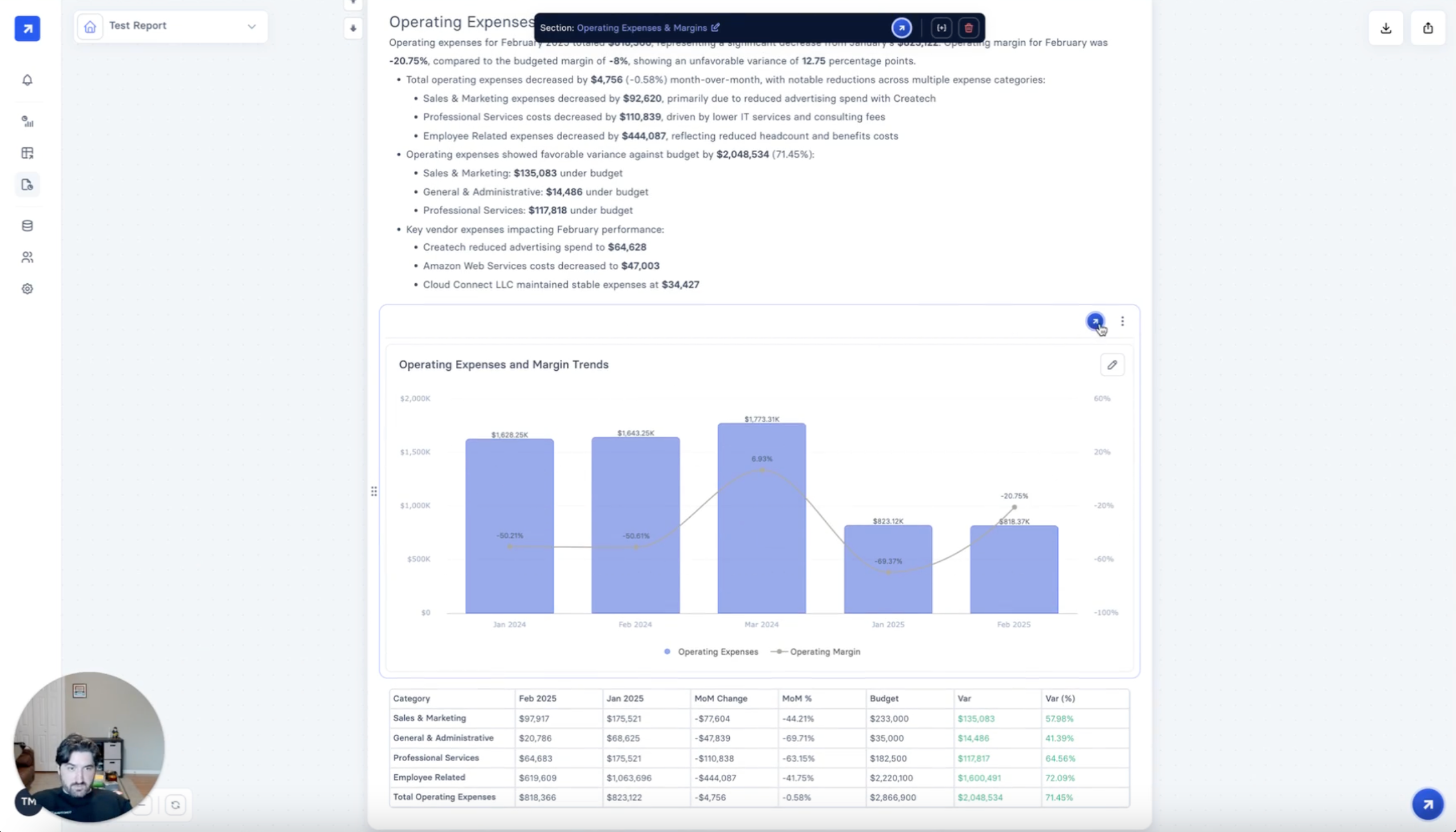

- Generate narrative insights that explain the "why" behind the numbers

- Learn from user feedback to continuously improve output quality

Implementation Without the Wait

Unlike traditional FP&A platforms that require months of implementation, Concourse AI Reporting Agents can be operational within days. The agent-based approach means there's no need for elaborate configuration before you can derive value—the agents learn your business context through interaction rather than through exhaustive setup processes.

Scaling Without Breaking

As your organization grows more complex, Concourse AI Reporting Agents grow with you. Additional data sources can be integrated without disrupting existing processes, and new reporting requirements can be addressed through simple prompts rather than technical reconfiguration.

The Human Element, Reimagined

Perhaps most importantly, Concourse AI Reporting Agents transform the role of finance professionals. Rather than spending 75% of their time on operational report generation, teams can focus on strategic analysis, business partnership, and forward-looking planning—all while leveraging more comprehensive and insightful reports than manual processes could ever produce.

Real-World Impact: Beyond the Theory

Finance teams using Concourse AI Reporting Agents have reported:

- 85% reduction in time spent generating routine financial reports

- 64% improvement in report accuracy compared to manual processes

- 93% increase in stakeholder satisfaction with financial reporting

- 78% more time spent on strategic analysis and business partnership

The Future of Financial Reporting

The artificial choice between automation and flexibility has constrained finance teams for too long. Concourse AI Reporting Agents demonstrate that the future of financial reporting isn't about choosing one or the other—it's about transcending the dichotomy entirely.

By combining the efficiency of automation with the adaptability of human-driven processes, AI Reporting Agents don't just optimize your current reporting workflow—they fundamentally transform what's possible in financial reporting.

Related posts you might like

March 3, 2025

Introducing: Concourse AI Reporting Agent

Discover how Concourse's AI Reporting Agent transforms financial reporting and deliver deeper insights that drive strategic decision-making

AI ReportingJanuary 13, 2025

The Future of Finance is AI: How to Leverage it Today

Discover how AI is revolutionizing corporate finance. AI is already transforming finance operations and driving results for modern corporate finance teams.

AI Insights